What no one tells you about copy trading

A deeper exploration into copy trading on Bitget

Nothing in this post is investment advice or recommendations. I am not a financial advisor and nothing stated here or implied should be considered financial advice.

The promise of copy trading

The attraction to copy trading is the premise that you will be able to simply mirror the trades of an experienced trader. All you need to do is find a trader who is successful and their trades can be your trades. In theory this should work; however, the difficult to near impossible task will be identifying who is actually very good at trading and who is not.

An experiment in copy trading on Bitget

I began experimenting with copy trading on Bitget by selecting a few traders based on their high rankings. I filtered out some of the traders looking at their dashboard data which shows recent wins/losses and profits.

You will be able to find many traders with impressive looking charts.

As well as some very impressive stats on their dashboard such as 100% win rates over hundreds of trades.

However, when I attempted to follow some of these traders, I was not getting these results. I was losing trades. Why? Mostly because I kept getting stopped out. So I increased my stop loss to 50% (which is very high) and was still getting stopped out of lots of trades.

At this point, I began to wonder exactly what are these traders using for stop losses. So to find out, I removed my stop losses. Then I began to make profits. Then as no surprise, a few days later I was liquidated as trades fell into over 1000% losses. However, most of the traders continued onward. Some took some large losses and others held them open until eventually closing them in profit.

So what went wrong and what is exactly going on with these copy traders? Let’s look some more at the data we can observe.

A deeper look into the dashboard data

A trader may look great at first based on graphs on their profile; however, further observations may change that viewpoint. The current open trades are listed under ‘Copy Trade’ under the orders tab. There are a couple of important points to observe in this sample.

Bitget only shows up to 30 open trades. We have no idea how many open trades this trader may actually have open. Therefore we are missing data that would help analyze the risk.

This trader has potentially massive losses pending in the open trades.

A very high ROI does not indicate a consistent winning track record. For example this trader, Gemini, has a very high ROI.

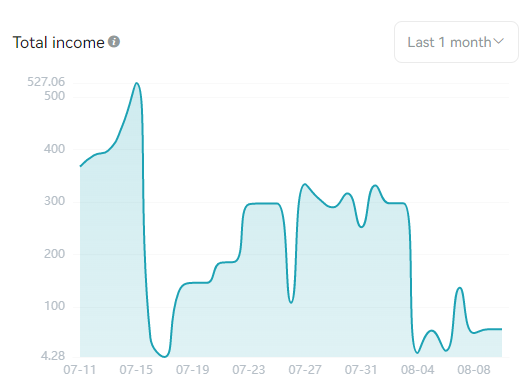

However, observe the total income graph

There appears have been liquidations for this trader’s account. However, once we are beyond a month, we will not be able to observe these events took place. We don’t know what negative events may be lurking in a traders history beyond the recent month as Bitget only allows for selecting 1 month as the maximum window to view.

What further information can we extrapolate from viewable data?

The top listed copy traders must be good, right? What if we try to actually analyze all of their trades by going back through their trading history a page at a time. Take all the data for these trades and then attempt to do some estimations on how much risk they took and what that means for you copying their trades.

Trader Hagesenseii

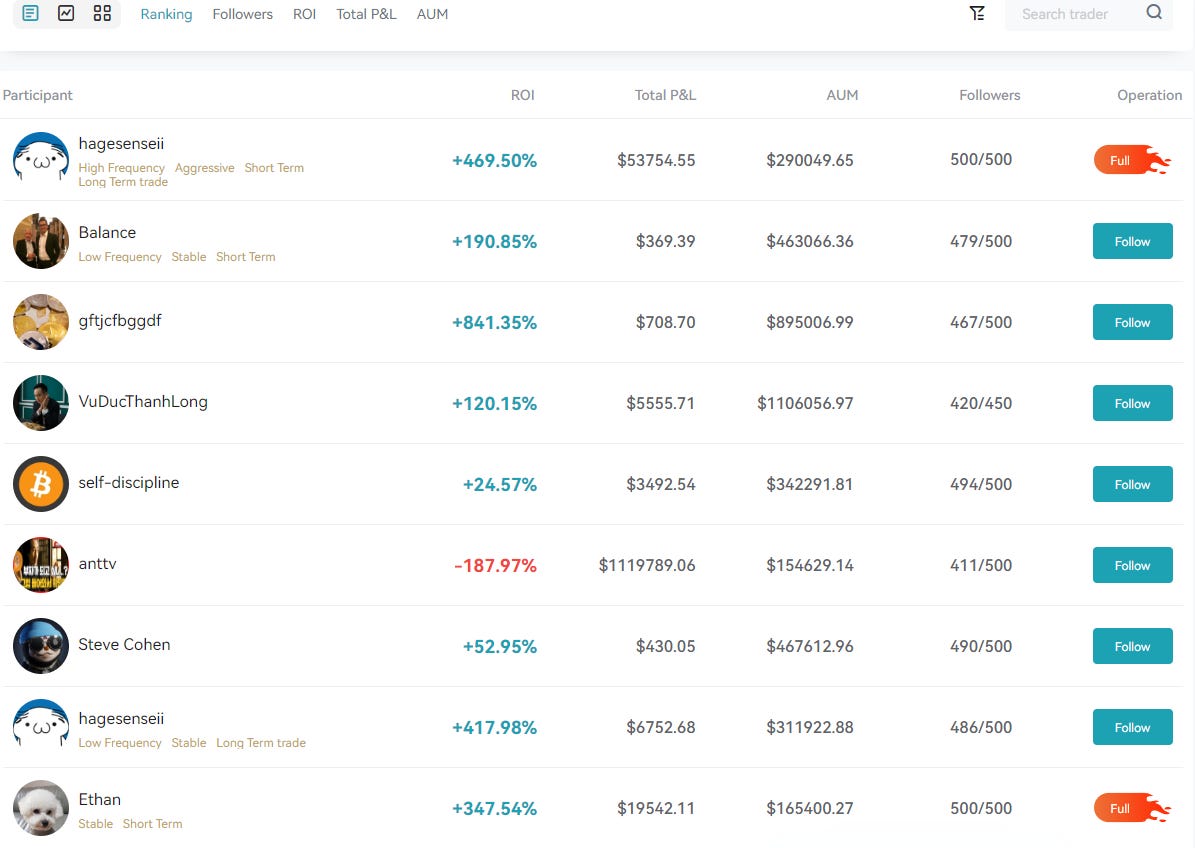

Let’s start with Hagesenseii who is currently listed in the ranking view.

Using the public available trade data, which is in the history tab of the trader, we have the open and close time of each trade. From this information we can understand how many trades were open simultaneously as well as what was the maximum draw dawn during these trades.

Note, we don’t have access to the raw data from Bitget, so these numbers will not be exact; nonetheless, we have a rough idea of trading behavior.

This took a large number of hours to analyze and pull the data together, but with the history data on the traders trades combined with exchange data downloadable from sites such as https://www.cryptodatadownload.com/ we can compute the following for Hagesenseii

This data is based on information for trades done this year 2022.

Average percent per trade overall: 56%

Average percent gain per trade: 206%

Average percent loss per trade: -145%

Max loss of a single trade: -1265%

Max concurrently open trades: 100

Max combined draw down of all open trades: -29600%

This trader stands out in several ways from other traders. They have a very high overall win per trade. We can also see that they have significant skin in the game as they are using much larger capital than most traders of a couple dollars per trade. We can observe this from the income chart moving by 10’s of thousands per day.

So if they are gaining 56% per trade, we should be thrilled to follow them. However, notice the extreme volatility and what appears may have been a liquidation event around 7-18.

The other interesting data point is at one point in time there were 100 simultaneously open trades. It is very important to understand what this means when trying to follow a copy trader and match their results. In Bitget, the minimum amount you can use to open a trade when you are following a trader is $10. Which means in this case we would have used $1000 just to open all the trades. Of course our account would need much more than that to cover the leverage. Around February 28th 2022 we can compute the maximum draw down which was -29600% when all of these trades were open. That means we are down nearly 300k!

It may seem the obvious solution is to limit the amount of capital you will use to follow a trader. The platform allows you to set a limit which would translate into how many trades you can open for a particular trader. So if we set our limit to $50, at $10 per trade we will only open 5 trades.

However, the issue is that we are no longer following the trader’s strategy and we can no longer expect the same results. This is because most traders are using some DCA strategy for opening and hedging positions. If you limit the trades, then you might just happen to only get into the losing trades and miss all the winning trades. This is exactly what happened to me in some instances.

Another alternative is that you can set the leverage yourself and override the trader’s leverage. However, for a trader like Hagesenseii, even at 1x leverage you would still need enough in your account to open 100 trades.

Trader Ethan

Let’s take a look at Ethan, another trader on the ranked listing. When we analyze the data for Ethan, it looks like the following:

Average percent per trade overall: 30%

Average percent gain per trade: 42%

Average percent loss per trade: -82%

Max loss of a single trade: -416%

Max concurrently open trades: 173

Max combined draw down of all open trades: -95048%

Ethan has an even higher number of trades that were open on 7-20 with an extremely high overall draw down for the account. Note, unlike Hagesenseii, Ethan is using much smaller trades as we can see by the income chart.

What strategy are copy traders using on Bitget?

If you are hoping to find traders that trade similar to your favorite content creator on youtube, or that book on trading you are reading, it is unlikely. Here are some takeaways from personal observations.

Many traders are using 50x leverage

Many traders are not using stop losses

Many traders are using extremely small trades of 2-4 dollars

Using very small trades allows the traders to take very high risk trades keeping them open until price recovers

This allows the trader to have a very high win rate which looks impressive; however, it is achieved through extreme risk

Many traders may have 20-100+ concurrently open trades

The more trades they open, the more they make in percentages from their followers which is likely incentive

Inevitably this means that you are likely taking on far more risk than you realize and possibly even greater risk than the trader you copy as they can open smaller trades (less than $10) than you can as a follower.

Some traders are using extremely small amounts of capital per trade, it may be they are using their followers who are following with substantially higher capital to somewhat offset their own risk as they earn a percentage from their followers.

Is it possible to make the platform better?

It would seem if we had more information about copy traders we could better select those with longer proven track records and better manage our risk when following. However, in reality this may never happen as it may not be in the best interest of the platform to do so. Why is that? In reality, great traders are very very rare. If we could honestly analyze the traders it is likely there would be very few anyone would want to copy. It is somewhat hard to build a copy trading platform without great traders. Therefore, it is likely in the interest of the platform to keep the dashboard statistics in a way that makes traders appear much better than they are in reality.

So why can’t everyone just follow the very few great traders? Likely because this would not scale. If everyone could follow the best trader on the platform, the capital would continue to increase until it would have adverse effects on the trades being executed.

Ironically, copy trading in its current form may remain a somewhat opaque high risk adventure because there is no other way for it to exist.

I have not evaluated other copy trading platforms and do not know to the extent they may be similar or different. I would be very interested in anyone who has more experience or has been successful at following traders over a long period of time and what they have learned.

Note: viewing trader historical trades

As of the moment of writing this post, it is not possible to view a traders history further back than 100 trades. This was not the case previously when this data was originally evaluated. It is not clear if this is simply a bug at the moment or if Bitget has decided to not allow seeing further back into a traders history.

Summary

The greatest challenge to understanding if it is possible to be successful copy trading is to understand the risk. Unfortunately, that is extremely difficult to do with the data that is available to see on each copy trader. Do not assume a trader has been vetted by any criteria that would make them a professional trader. Most listed traders have only been copy trading a few weeks or months based on what data we can see. Many have deep losses that we can not observe because the viewable information only tracks back for 1 month on the charts. We don’t know many potential concerning aspects of their trading strategy without investing lots of manual effort to analyze their individual trades.

All information gathered was done on best effort basis, is not audited or guaranteed to be accurate.

Nothing in this post is investment advice or recommendations. I am not a financial advisor and nothing stated here or implied should be considered financial advice.

this post on copy trading is really informative and well written! thanks for the insights :)

I wish more traders would read this.